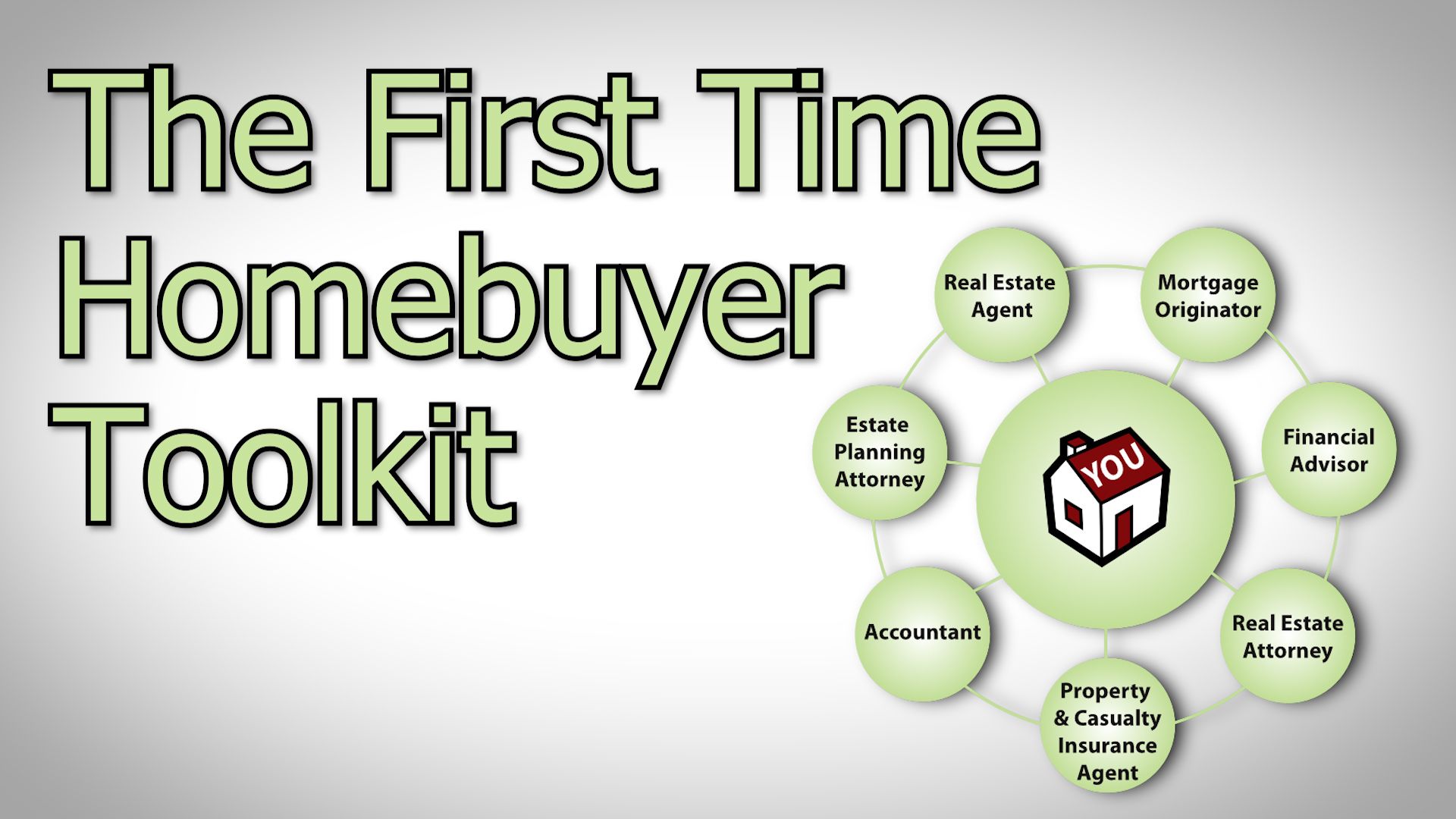

What professionals do I need on my team?

What documentation will I need to get Pre- Approved?

How much do I need to put down?

What questions do I need to ask each professional?

What questions do I need to ask myself?

What other financial ramifications do i need to think of when buying my first home?

Better yet, you’ll FINALLY have the PLAN you’ve been hungry for. You’ll know exactly how to think, what to do, and what your next steps should be...

In The First Time Home Buyer Toolkit, I’ll teach you about:

- Documentation Needed for Pre-Approval

- Credit Scores

- Debt to Income Ratios

- Adjustable Rate Mortgages vs. Fixed Rate Mortgages

- Mortgage Rates/Rate Fluctuation

- Closing Costs and No Cost Loans

- Paying Points, Escrow Accounts & Pre-Paid Interest

- Tax Deductibility of Mortgage Interest

- The Cost of $10,000

- 30 Year Loans vs. 15 Year Loans

- Selling Your Home 1997 Tax Payer Relief Act

- Cost of a Wedding

- Final Walkthrough

- Seller Concessions

- The Real Estate Attorney and Owner’s Title Insurance

- Procrastination and the Cost of Waiting 1 year

- Elvis Presley and Estate Taxes

- The Cost of College